Poverty

Poverty

As we get to grips with the Covid-19 crisis the Bevan Foundation will be running a series of guest blogs looking at the impact of the virus on different aspects of life in Wales. To kick start our series, Cian Siôn, Research Assistant at Wales Fiscal Analysis, Cardiff University looks at which households are most vulnerable to a loss of income because of Covid-19.

It is becoming increasingly clear that – along with its stark health implications – the Coronavirus (Covid-19) pandemic will have a profound and lasting impact on the Welsh economy and society.

Though it is too soon to predict the long-term impact, we know that in the short-term, large sections of society will be required to self-isolate, and many people – particularly the self-employed and those on zero-hours contracts – will have to forgo their regular income from employment. The benefits system offers a limited safety-net, but unless further action is taken, many households will have to rely on savings and other liquid assets to pay their bills and meet ongoing commitment such as mortgage and rent payments.

Trends in household saving are particularly salient to understanding which sections of society are most vulnerable to a drop in their regular income.

After the Fraser of Allander Insitute published an analysis of liquidity-constrained households in Scotland, we have analysed data from the Wealth and Assets Survey to see how many Welsh households have enough savings and liquid assets to cover a month, two months and three months of their regular income. The definition of liquid assets is taken from this DWP report.

Around two-fifths of Welsh households lack the savings and liquid assets necessary to replace their regular income for three month. And more than a quarter of Welsh households don’t have enough savings to cover their regular income for just one month.

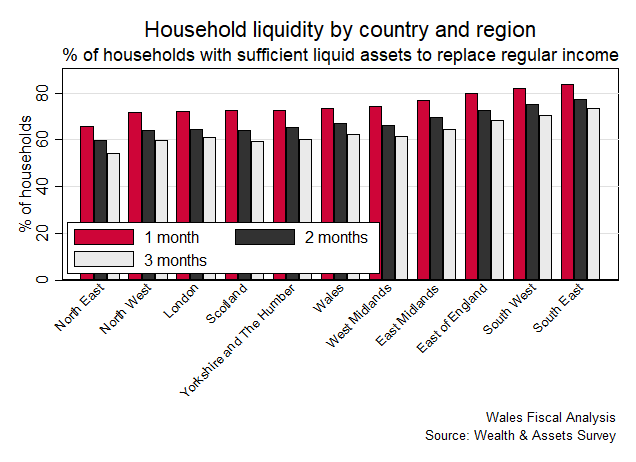

Wales is not out of line with the UK average on these measures, with lower levels of saving being offset by relatively lower levels of income.

But there are several factors that influence how likely it is that any given household would be liquidity-constrained if they faced a loss of income.

1 – Household income

Only 55% of Welsh households in the poorest income decile have enough liquid savings to cover one month of their regular income. This compares to 94% of households in the richest decile.

Since richer households have higher levels of regular income, these households require more savings to offset a loss of income. But in general, commitments such as rent and mortgage payments tend to grow as we move up through the income deciles as well. This means that a household in the fifth decile may not have the ability to save much more than a household in the second decile, as a proportion of their income.

This might explain why it is only in the top deciles that we see a marked increase in the likelihood of households having enough liquid assets to replace their regular income over an extended period of time.

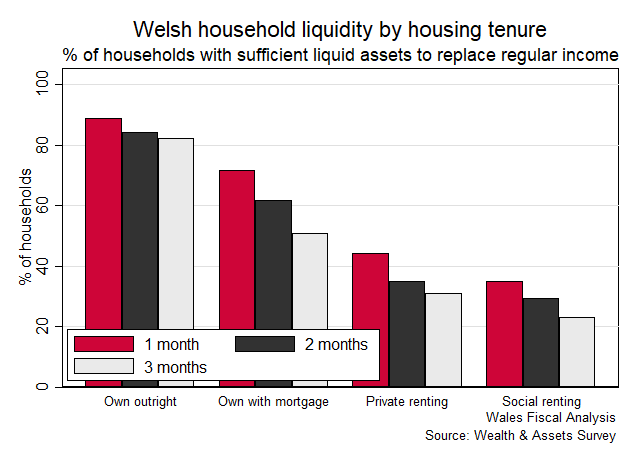

2- Housing tenure

Renters would be particularly badly hit if their income suddenly stopped – only 44% of private renters and 35% of social renters in Wales have enough savings to cover one month of their regular income. The statistic for private renters in Wales stands out as being significantly lower than the UK average of 55%.

Owner-occupiers who are still repaying their mortgage fare slightly better – 71% of these households have enough liquid assets to cover a one-month period without regular income. The UK Chancellor’s announcement that these households will be given the option of taking a ‘mortgage holiday’ further shields them should they lose their regular income.

Given that owner-occupiers were already set to fare better than those who rent, this makes the UK and Welsh governments’ failure to implement anything more than half-baked measures to protect tenants facing a loss of income due to Covid-19 particularly glaring.

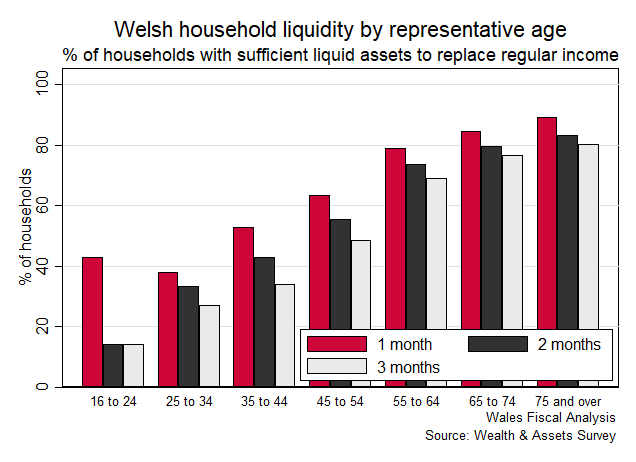

3- Age

Younger households are much less likely to have enough resources to cover a drop off in income than older households. Less than two-fifths of 25 to 34-year-olds have enough savings to replace a month of their regular income compared to nearly 90% of over-75s. This reflects lower rates of home ownership and that younger households tend to have less accumulated savings.

It also bears mentioning that older households – particularly those of state pension age – are much less likely to lose their regular income because of Covid-19.

How should the Welsh and UK governments respond?

Of course, the benefits system offers some protection against a sudden drop off in income. But given that the value of Statutory Sick Pay is less than 18% of the median income in Wales, many households will still not be able to cover their bills and existing commitments. Those earning less than £118 a week or the self-employed might have to rely on an even less generous Employment and Support Allowance or navigate the Universal Credit system.

Poorer households and renters seem particularly vulnerable to a loss of regular income. The UK government has implemented a moratorium on evictions in England but the Welsh Government is yet to take such action. Though this would offer greater security in the short-term, it would not prevent tenants from being evicted at a later date. As argued by the Bevan Foundation in a blog earlier this week, flexible payment arrangements already on offer to landlords should be made available to all tenants as well.

And younger households are much less likely to possess enough savings to replace their regular income. Given that a proportionately larger number of younger adults work in the gig economy compared to other age cohorts, these households could also be more vulnerable to losing their income the first place. In this context, the lower rate of Employment and Support Allowance and Universal Credit paid to under-25s seems particularly incongruous.

The UK and Welsh government have already announced a large fiscal response to Covid-19. But so far, most of this support has been directed at businesses in the form of government-backed loans and non-domestic rates relief. Further action will be needed by both governments to protect liquidity-constrained households in Wales from the economic fallout of this pandemic.

Cian Siôn is a Research Assistant at Wales Fiscal Analysis, Cardiff University

Dear Cian Siôn and the Bevan Foundation team,

I am writing to express my appreciation for the insightful analysis provided in your post regarding the financial vulnerability of Welsh households during the COVID-19 pandemic. The detailed breakdown of different factors influencing households’ financial stability was enlightening.

Now that some time has passed since this post was published, I am curious to know how the predictions and analysis presented in this post compare with the actual economic impacts observed in the subsequent years. Were there any notable discrepancies between the predicted vulnerabilities and the actual economic outcomes for Welsh households? Additionally, were there any subsequent measures taken by the UK or Welsh governments that significantly alleviated the financial strain on the identified vulnerable groups?

Your analysis provides a solid foundation for understanding the economic implications of the pandemic, and I am keen to learn about the developments that followed, especially any policy interventions that might have mitigated the financial challenges faced by the vulnerable segments of the population.

Thank you once again for shedding light on this critical issue. I look forward to any further insights you might have regarding the economic repercussions of the pandemic and the measures taken to address them.

Warm regards,

Will