Poverty

Poverty

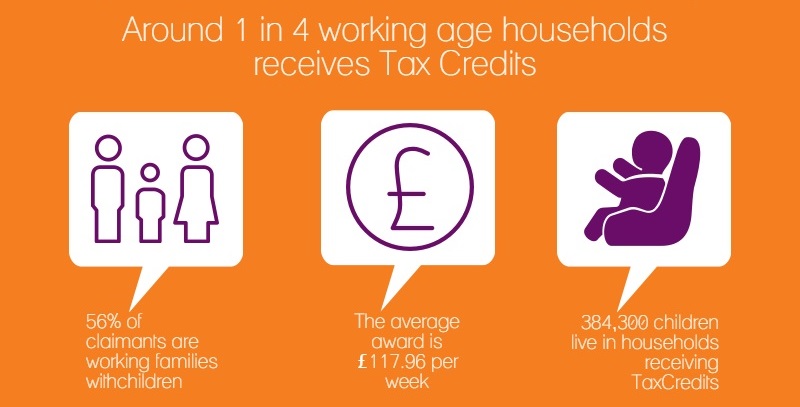

A unique analysis of Tax Credits claimed in Wales shows that nearly a quarter of a million households in Wales and 384,000 children rely on them to make ends meet, according to independent think tank the Bevan Foundation.

The study of figures produced by HMRC shows that seven out of ten of households claiming Tax

Credits have at least one adult in employment. Most of the households who receive Tax Credits have low incomes, usually because they either have low pay or work part-time. The Bevan Foundation found that over three-quarters of households getting Tax Credits had gross taxable incomes of less than £20,000.

Bevan Foundation Director Dr Victoria Winckler said: “Tax Credits are an extremely important part of the benefit system that ‘make work pay’ for many households. On average, they contrib

ute about £100 a week to a family budget, helping to cover the costs of essential household expenses and childcare while parents are at work.”

The proportion of working age households that receive Tax Credits

varies across Wales, from a high in Merthyr Tydfil of 32% to a low in Monmouthshire of 19%.

Victoria Winckler said: “Tax Credits matter in all parts of Wales – even in relatively well-off areas about one in five working age families rely on them, while in areas with low average pay like Merthyr, Pembrokeshire and Conwy, this rises to one in three working age households.”

Altogether the Tax Credits paid out in Wales total £1.46 billion, a substantial cash injection into the Welsh economy.

To download the summary briefing, please visit our publications page. To download the full briefing, please visit the members’ area of the website or join now.